SkyWalker Property Partners has scored the first industrial asset for its Cash Flow Fever fund in a sale-leaseback transaction with AMACS Process Tower Internals for its headquarters and manufacturing hub in southwest Houston.

AMACS signed a 15-year lease with annual rent increases as part of the trade for its longtime home, a 67,161-sf office/warehouse at 14211 Industry St. AMACS, which also has an office in The Netherlands, is a leading provider of components for process towers and vessels in the refinery, petrochemical, gas processing and industrial sectors.

"We are focused on diversifying the fund's portfolio this year, subject to market conditions," says Clint Holland, acquisitions director for Arlington, Texas-based SkyWalker Property Partners. "We're looking to buy five, sell eight and diversify with good opportunities."

Holland and Gary Walker, managing principal of SkyWalker Property, represented the buyer of record, Houston, We Have A Solution LLC. AMACS' predecessor, Amistico Separation Products Inc., had the property listed with Zane Marcell of JLL, who negotiated on behalf of the seller.

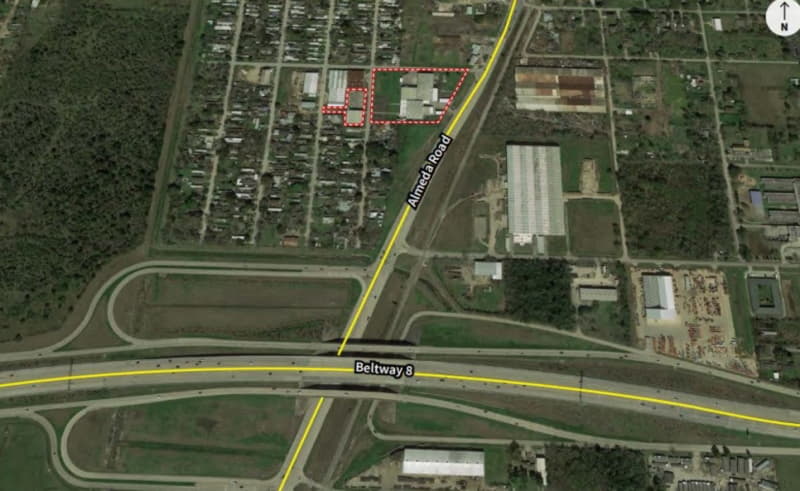

The AMACS' building was developed in 1968 and expanded through the years. The site, totaling nearly six acres, is set just inside Beltway 8 and less than 20 miles from the Port of Houston, the largest in the nation for foreign waterborne tonnage. The Industrial vacancy in the southwest industrial submarket at year's end was 6.8%, which is slightly lower than the region's average and a telling sign of its economic vitality.

AMACS is owned by Rockwood Equity Partners, which invests in lower to middle market niche companies in North America with sales of $10 million to $75 million. AMACS manufactures highly engineered components for new builds, replacement and the OEM marketplace.

"AMACS has been there for years. The complex's functionality impressed us," Holland says. "We moved quickly once we saw how it fit the company's needs and business."

Cash Flow Fever, launched in 2016, is focused on building a portfolio of income-producing properties in Texas and neighboring states. The investment fund's plan for the AMACS property is a long-term hold.

"We're looking at other properties that are similar to this one, including in smaller markets like Tyler and Tulsa. We really like this asset class from an investment perspective," Holland stresses. "The pricing and return for the risk are a better fit for our firm's capital and our investors' funds."

SkyWalker Property Partners identifies, underwrites, acquires and executes highly opportunistic and value-add investments on behalf of When Opportunity Knocks LLC and Cash Flow Fever LLC, funds formed in 2017 to build a $200 million portfolio of office, industrial and retail properties in Texas and surrounding states. The strategy targets transactions from $2 million to $15 million. Additional information about the investment group is available at www.SkyWalkerProperty.com.